Forex Basics Step-By-Step

If you are new to Forex or just want to get a clearer understanding of the basics, you are in the right place! This is your first step towards mastering Forex step by step way to trading forex.

All the information you need to start your Forex trading journey is right here!

I have organized the last 13 years of my trading experience into this beginner’s course. Your time is valuable, so I have specifically designed this course to be efficient, easy-to-understand, and thorough. There are a lot of basic trading guides out there and compared to others this one may seem a little shorter.

What is Forex Trading & How it works?

Forex

trading, also known as foreign exchange trading or currency trading, works on

the principle of making a profit from the fluctuation in price movements of the

two currencies in a currency pair.

Trading in the forex market is very popular globally & also in Nigeria.

According to estimates that there may be as high as over 250,000 forex traders in Nigeria currently.

Forex trading involves understanding the basics of trading, certain instruments involved, and how the market works, and how to become a trader. We will explain them all in this tutorial.

Forex

trading involves trading different currencies in the global foreign exchange

market against one another. Forex Trading is done in Foreign Exchange Market

via a forex broker.

Foreign Exchange Market is one of the most actively traded markets in the world. The FX market has an average daily trading volume of close to $6.5 trillion as per the recent reports by BIS.

The buyer or seller speculates on their bias on the currency’s movement in the future and gets into a forex trade. This market has a high risk involved and is directly traded between two parties, OTC (over the counter) market.

There

is no central location in this market. Forex trade can be done 24 hours a day. Let’s

take an example: USD (US Dollars)/NGN (Nigerian Naira).

If you

want to buy US Dollar by exchanging it with Naira, for this, you need to spend

NGN equal to the FX rate of USD/NGN. In this case, you would buy US Dollars if

you are expecting USD to get stronger in the future against Naira.

Trading Terminologies

These are a few basic terminologies that you will come across once you are actively trading in the forex market.

Base & Quote in a currency pair: Every currency pair has a base currency vs a quote currency. The base currency is the buying currency when you trade the forex trade. The quote currency is the selling currency when you trade a forex pair. For example, GBP/USD. Here GBP is the base currency and USD is the quote currency.

Bid & Ask prices:– Trades for any currency pair takes place at Bid & Ask (or Order) prices. These are quoted by the brokers or Market Makers who facilitate such trading. The bid price is referred to as the price at which the buyer would want to buy the foreign exchange and the Ask price, the price at which the seller is offering the foreign exchange.

The Bid/Ask prices are always quoted in pairs for trading. For example, if the pair of USDCAD is trading at 1.4084/1.4284, that means you can sell 1 USD for 1.4084 CAD and you can buy 1 USD at a cost of 1.4284 CAD.

Currency Pairs (Majors, Minors, and Exotics):– Trading in the forex market always involves 2 currencies together & against each other. Like 1 EUR against US Dollar.

The currency pairs in which the foreign exchange is done are divided into three major categories.

- Majors are the currency pairs that have the highest trading activity. There are 7 majors.

- Minors are generally the currency pairs that are crosses of pairs in Majors except for US dollars.

- Exotics are currency pairs of emerging economies & other countries. These generally have low trading volume, so can be very volatile.

How the forex market work?

The fluctuation in the demand and supply of these currencies affects the exchange rate. Eg: If there is an increase in demand for US Dollars due to a global fundamental shift, then it will rise against most other currencies that have weaker demand than US dollars.

So, what affects or creates the supply & demand?

The Forex Market has several factors that influence the supply & demand for a currency. Let’s see some major factors which come to play in a forex market:

There are 3 major factors that affect the currencies fundamentally:

Economic Outlook & Conditions: Economic conditions are the most important factor. In the case of present times, where we are facing the global Covid -19 pandemic, strong economies like the USA, considered as one of the most powerful economies, have also been affected by this pandemic. Any changes in the economic activity of the countries affect their trading abilities and hence, affecting their currency rates.

This has made the once stronger currency, like USD, weaken to some extent in the current situation due to the weak economic outlook in the US. The currency pairs with USD can be now bought and sold in the forex market cheaper than before. Economic conditions in a country have a major impact on the exchange rate of their currency.

Central Banks: Central banks play a pivotal role in the currency’s outlook because they act as gatekeepers, policymakers related to the country’s economy.

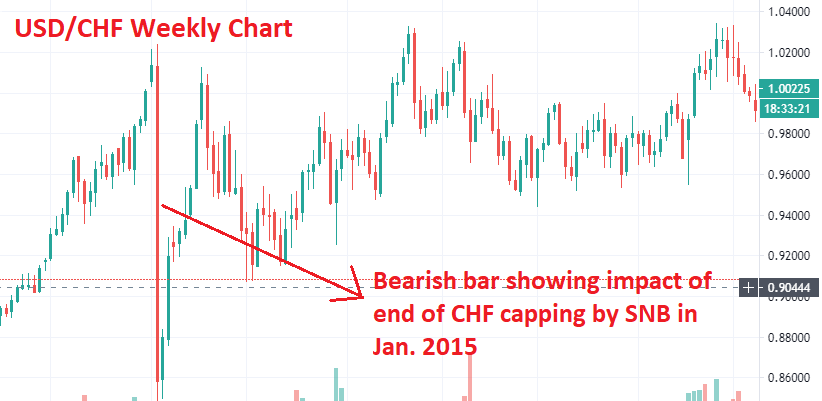

Any policy change or negative/positive outlook on the economy by Central Bank’s policies would impact the currency of the country. Eg: During the end of capping on CHF (Swiss Franc) by the Swiss National Bank, caused major movements & very high volatility on CHF pairs in 2015, that even led to some brokers filing for bankruptcy.

Economic News: Economic news affects the foreign exchange market in various ways. The inventors speculate the rise or fall of a currency vs the currency pair. As speculation comes into the picture, the speculation is solely done on the economic news that is seen and read on daily basis. The economic news is followed and studies. Decisions are made basis the rise or fall in the world economy on daily basis.

Market Sentiment: Market sentiments, like the above factors, also are related to the perception of the market makers and other parties involved in the trading. There may not be any positive or negative news, but based on what the market participants feel about the economic and market conditions, the currencies can get affected. Hence, market sentiments too should be kept in mind while taking any trading decisions.

Why Forex Trading is Risky?

Forex Trading involves huge risks, just like any other investment instrument. It is important that you learn about these risks.

Let’s see the 5 major risks that should be kept in mind before trading:

High Leverage Risk: Most brokers offer margin trading, with which you can trade with more money than the actual capital that you have invested.

Let’s say that your broker offers 1:10 leverage. Using this as an example, with just $100 of your own capital, you can trade as high as $1000 worth of assets. But this can be very risky, as this can magnify your losses exponentially if you are using very high leverage.

Hence regulatory bodies keep a tight vigil over the leverage offerings by brokers, in order to protect the investor money. You should keep in mind the risk leverage brings along with it and should use it cautiously.

Interest Rate Risks: A country’s interest rate is directly proportional to the strengthening of its currency due to the inflow of investments in that country’s assets. A stronger currency provides high returns.

Simultaneously, if the interest rate falls, the investments are withdrawn, hence weakening the currency. Therefore, changes in interest rates, make the currency values fall or rise. Hence having an effect on the exchange rate of the currency pairs.

Since the decision on any economic decision by Central Banks is not in control of any investor, it can be very risky if you are trading during any such news.

Counterparty & Broker Risk: Counter-party risk refers to the risk of default from either the dealer or broker in a transaction. In such cases, a guarantee of completion of trade is at risk, generally arising from the solvency of the dealer.

Hence, choose a broker that is reputed like these Top tier regulated forex brokers in Nigeria that we have compared & listed.

Country Risk: Country risk refers to the risk of investing in the currency of a country with weak economic conditions and having a risk of the currency crisis. Such cases arise from huge deficits and debts on the country, political instabilities, and other such conditions that devalue the currency.

This is a major risk if you are investing in a weak exotic currency, that is not traded that much. Beginner currency traders should stick to majors, pairs with high liquidity.

Forex trading can give one the opportunity to earn profits, but you must understand the risks. You should do enough research and understand fully the risks that are involved and plan your trading activity accordingly.

How to Become a Forex Trader

So you want to learn how to become a Forex trader, great!

But wait – before you go any further, I want to make sure you are prepared for what lies ahead. Because I want you to approach Forex with realistic expectations.

Many new traders I talk to want to get rich quick with minimal effort.

If anybody promises you that they are lying because Forex is not a get rich quick scheme.

Trading requires a time commitment and realistic expectations. It is not easy and you should expect to see a year or two of trading before becoming profitable. Forget what you have read on sites trying to sell you trading as an easy money-maker.

So please, ask yourself right now…

Can you dedicate the time and patience needed to become a successful trader?

Are you ready to commit the next one or two years to master Forex?

If your answer is no, you can never become a trader.

If your answer is yes, then let’s get started…

What do I need to Become a Forex Trader?

You don’t need any fancy equipment to start trading Forex. You most likely have everything you need already!

- A computer or smartphone (preferably both).

- A stable internet connection.

- A comfortable chair.

A supercomputer with a multiple monitor setup is not a requirement to trade. Price Action is a simple and low maintenance strategy that is flexible around you. So long as you have a computer made in the last 5 years, you are all set!

What does Forex cost?

To start with, Forex trading won’t cost you a thing. You should spend your first year trading a demo account. That way if you lose, you don’t lose any of your real money.

When you start making consistent profits with your demo trading, you can think about opening a live account! This is where your first costs will come in.

Fortunately, the costs will be relatively low – you can open a live account for as little as $100. Realistically, you will open a larger account. When you open your first live account, you should be looking to start with around $300-$1000.

Remember, it takes time and patience to master Forex. You need to start small with your first live account and slowly add to it as you become more comfortable with live trading.

After your first year or two of live trading, you should be making consistent profits. If that is the case, you may want to consider opening a serious account.

This can be flexible – trade with what you can afford to lose. I have seen traders start accounts with as little as $1,000 and succeed. However, a more realistic amount would be $5,000.

Overall, Forex costs you very little – particularly when you start. This is great as it means there are no barriers in your way to giving Forex a shot! You only need to invest a significant amount of money when you feel ready.

Learning Forex Trading

We have created guides on various concepts of forex trading for beginner traders.

You can read our guides to learn the basics.

Here are some more guides:

- What is leverage in Forex Trading?

- Best time to trade Forex in Nigeria?

No comments:

Post a Comment